coweta county property tax due date

If you wish to attend please confirm the schedule directly with the office. Ad Search Coweta County Records Online - Results In Minutes.

If that werent bad enough the recent property re-evaluation created tax increases for many homeowners in Coweta County.

. Property taxes levied for the property tax year are payable in two installments. Coweta County GA. The Coweta County GA Website is not responsible for the content of external sites.

Publish notice of dates when taxes due and delinquent. Property tax returns must be filed with the county tax office between January 1 and April 1 of each year. Tax bills are mailed on October 1 or as soon as possible thereafter to real and business personal property owners throughout the county.

To pay online visit their website at e-prop. Website Design by Granicus - Connecting People and. Coweta County collects on average 081 of a propertys assessed fair market value as property tax.

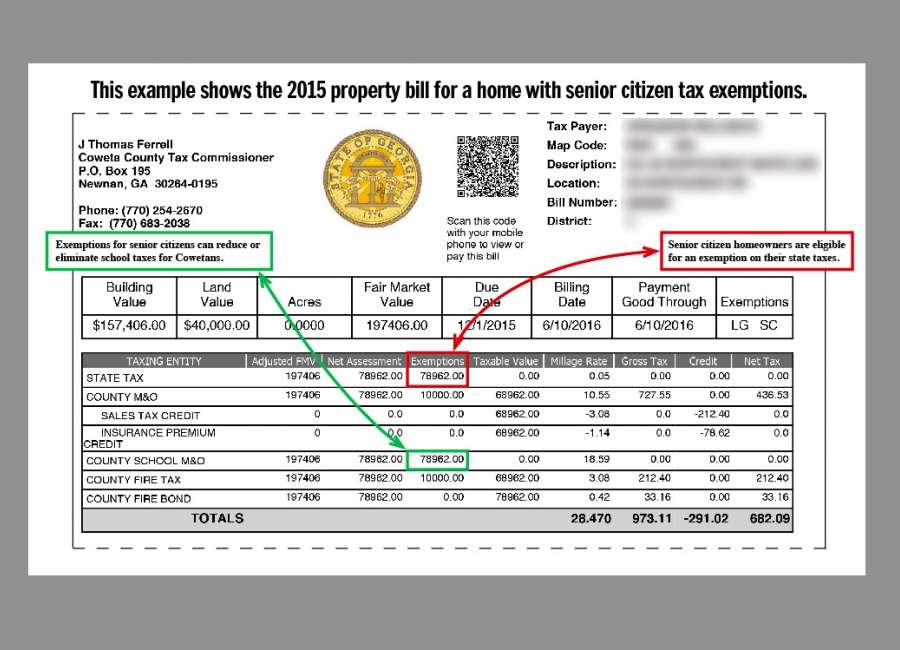

Georgia is ranked 841st of the 3143 counties in the United States in order of the median amount of property taxes collected. A 25 percent discount is allowed for first-half property taxes paid before September 1 and for second-half property taxes paid before. VOTE NO NEW SALES TAXES.

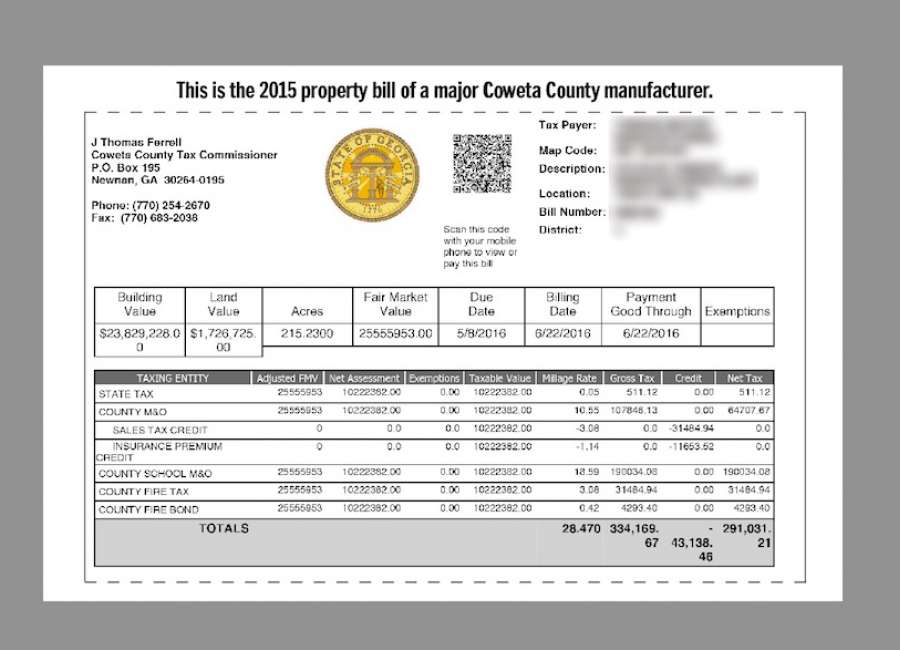

Beginning in 2015 City of Newnan property taxes have been billed and collected by the Coweta County Tax Commissioner. Together with Coweta County they count on real property tax receipts to perform their public services. Property or Ad Valorem Taxes Sales Taxes ELOST SPLOST FinesForfeitures.

Lien date for the assessment of property on the assessment roll. Funding sources for Coweta County include. You should check with your county tax commissioners office for verification.

Last day to pay second installment of regular property taxes secured bill without penalty. Taxes constitute a general lien upon all property of a taxpayer within the State of Georgia and the lien attaches on January 1st of each tax year even though a fi. Taxing authorities include Coweta county governments and numerous special districts eg.

There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments. The digest is used by the various local taxing authorities the Coweta County Commissioners Board of Education and city councils to set the property tax millage rate and property taxes are due in late 2020. Property Tax Installment Payments.

On or before November 1. Coweta County Property Tax Increase 2020. Georgia depends on property tax income a lot.

Prior to that year City residents received two separate tax bills with two different due dates. AUGUST 31 - Unsecured Property Tax payment deadline. If ordered by board of supervisors first installment real property taxes and first installment one half personal property taxes on the secured roll are due.

Taxes due the state and county are not only against the owner BUT also against the property regardless of judgments mortgages sales or encumbrances. The Board of Assessors typically meets the first and third Wednesday of each month at 900 AM. Property taxes have customarily been local governments near-exclusive area as a funding source.

Even though the official due date for ad valorem tax payment is December 20th the local governing authority may adopt a resolution changing the official due date for tax payment to December 1st or November 15th or may implement installment billing with multiple due dates. You are now exiting the Coweta County GA Website. SEPTEMBER 1 - Unpaid Unsecured Property Taxes are transferred to the Collections Division.

NOVEMBER 30 This is the last day to make the first payment on the half payment option. You will be redirected to the destination page below in 3 seconds. August 31 Last day to pay taxes on unsecured tax bills without penalty.

Coweta County property taxes are due Dec. Last day to file property tax exemptions. July 2 First day to file assessment appeal applications with the Clerk of the Board of Supervisors.

The Tax Collector is responsible for the collection of all tax payments. The assessment roll is the official list of all taxable property within the County. The first installment is due September 1 of the property tax year.

Many had hoped the millage rate would be rolled back but the Coweta Board of Education voted a tiny savings to the average homeowner of less than 20 a year. Find Information On Any Coweta County Property. 2022 Property Tax Calendar.

Thank you for visiting the Coweta County GA Website. All taxable real and personal property is valued as of Jan. The second installment is due March 1 of the next calendar year.

1 and payable in the following tax year RCW 8436005 and RCW 8440020. The basic exemption for this county is 2000 on state and school and 5000 on county and fire Please call the Tax Assessors office at 706-291-5143 For Exemptions and Personal Property returns Notice Is Hereby Given that the Lackawanna County Board of Commissioners Meeting originally scheduled for Wednesday. Treasurer submits the County Property Tax Collections Calendar Year report to the DOR Research and Fiscal Analysis Division.

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. Dispose of my Trash. On or before November 1.

A 10 penalty plus 30 collection fee are added if not postmarked by August 31 received in our office as of 500 pm or before midnight online. 1 of the assessment year for taxes due Jan. STOP Critical Race Theory CRT.

Object Moved This document may be found here. Now all Coweta County residents and businesses receive one tax bill due and payable by December 1st to the Coweta County Tax Commissioner. Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263.

Has not been issued. Georgia communities count on the real estate tax to fund public services. In the Conference room of the Board of Assessors office located at 37 Perry St building Entrance D.

However as a condition to receiving such an extension the county board of tax assessors shall at least 30 days before the expiration of the 180 day period provided under subparagraph A of this paragraph notify each affected taxpayer of the additional 180 day review period provided in this subparagraph by mail or electronic communication including posting notice on the. They all are public governing bodies administered by elected or appointed officers.

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Newnan Coweta Board Of Realtors Ncbor Home Facebook

15 000 Reward Offered In Fatal Shooting Of Georgia Gun Range Owners And Grandson Abc News

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Coweta School Board Finalizes Approves 2022 23 Budget Winters Media

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald